Property Marketing Review – May 2022

Return to the office

According to a recent business update, London’s office-leasing market is kicking back into life after its pandemic-induced slumber, with modern and energy-efficient space most in demand.

Companies are willing to pay higher rents for leases than they were a year earlier, according to Derwent London, a FTSE 250 office landlord. The value of its new lettings have risen to £3.9m in the year to date, 8.2% above the estimated rental value in December.

With the rise in flexible working, however, office occupancy remains far below pre-pandemic levels. Nationwide, the figure is currently about 26%, according to Remit Consulting, a significant fall from 60% before the pandemic.

This low occupancy rate has allowed new tenants to focus on securing high-quality space. Occupiers’ requirements are narrower but more immutable, Derwent said, with modern, energy-efficient offices that contribute to lowering a company’s carbon emissions highly sought after.

Strong demand but caution endures

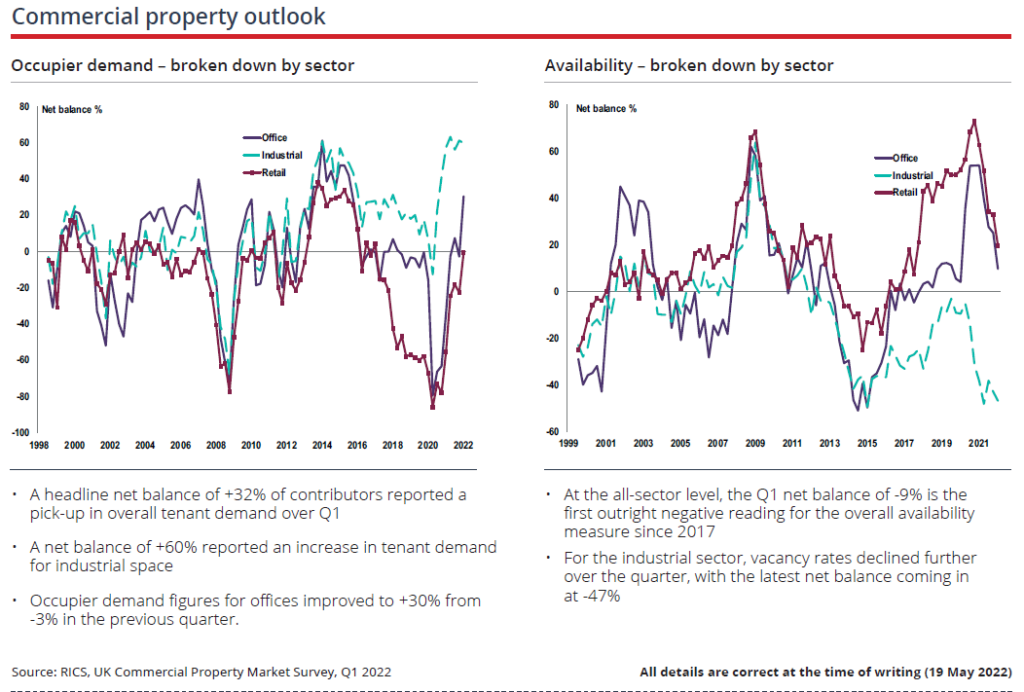

The commercial market gained momentum in Q1 2022, according to the latest Royal Institution of Chartered Surveyors UK Commercial Property Survey, with demand growth accelerating at the headline level for both occupiers and investors.

A net balance of +32% of respondents reported an increase in occupier demand at the all-sector level, the strongest reading since 2015. The office occupier market was a top performer in the quarter, increasing its net balance from -3% to +30%. Office occupier demand in the retail sector returned to -1%, following level of -23% in Q4 2021.

Investor demand was strong too, with a net balance of +32% of respondents reporting an increase in buyer enquiries at the all-property level. Alongside a steady increase in the supply of leasable office and retail space, sustained demand has led to the all-property capital value expectations being revised higher for the coming year.

Despite these strong figures, however, many contributors remain cautious in the face of macroeconomic pressures. Rising living costs and higher interest rates are causing some to point to a growing sense of nervousness in the market.

Logistics quarterly round-up

Uptake of logistics space in Q1 2022 totalled 10.43m sq. ft, according to CBRE’s latest UK Logistics Market Summary, twice as high as the corresponding figure in 2021.

Correspondingly, the UK vacancy rate fell in the quarter and currently sits at 1.55%. Ready-to-occupy supply also dipped slightly on a quarterly basis, meaning it has now fallen 55% year-on-year.

This busy activity, however, is being matched by increased speculative activity. The total speculative under construction space at the end of the quarter was 14.97m sq. ft. Even though more than a third has already been taken, the year ahead should be busy, the report suggests.

Continuing the trend, nearly all UK regions experienced rental growth in the quarter, as UK prime rents recorded yet another new record. Driven by this strength, Q1 industrial and logistics investment volumes, although lower than Q4 2021’s record levels, have risen 19% year-on-year.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.